Getting the occasional reduction arrives component and parcel with investing on the inventory market. Anybody who held The Natural beauty Health Firm (NASDAQ:Pores and skin) around the last 12 months is familiar with what a loser feels like. In that relatively short period, the share price has plunged 63{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488}. We would not rush to judgement on Splendor Overall health simply because we you should not have a prolonged term record to look at. Also, it is really down 24{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488} in about a quarter. Which is not a great deal enjoyable for holders. This could be relevant to the current economic benefits – you can catch up on the most latest info by looking at our organization report.

If the previous week is anything at all to go by, trader sentiment for Splendor Health and fitness is just not constructive, so let us see if you will find a mismatch involving fundamentals and the share rate.

Check out our latest examination for Attractiveness Health

Supplied that Elegance Wellness failed to make a income in the last twelve months, we’ll aim on earnings growth to type a rapid see of its business enterprise growth. Typically talking, corporations with no profits are expected to expand earnings each yr, and at a great clip. As you can picture, rapidly earnings advancement, when preserved, generally prospects to rapidly profit expansion.

Attractiveness Health and fitness grew its earnings by 74{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488} in excess of the last year. Which is a sturdy result which is much better than most other loss creating corporations. In contrast the share value is down 63{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488} above twelve months. Sure, the market can be a fickle mistress. Normally a expansion stock like this will be risky, with some shareholders involved about the crimson ink on the base line (that is, the losses). Commonly speaking buyers would take into account a inventory like this fewer dangerous at the time it turns a profit. But when do you think that will come about?

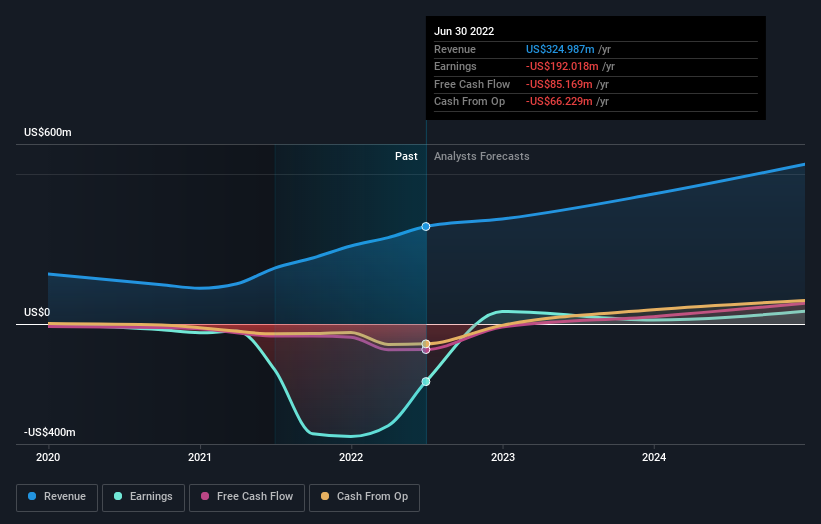

The graphic below depicts how earnings and income have altered above time (unveil the exact values by clicking on the picture).

Magnificence Wellness is a effectively known inventory, with plenty of analyst protection, suggesting some visibility into long run development. Presented we have very a excellent selection of analyst forecasts, it may well be very well truly worth checking out this totally free chart depicting consensus estimates.

A Distinct Standpoint

Natural beauty Well being shareholders are down 63{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488} for the yr, even worse than the industry reduction of 24{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488}. There is certainly no doubt which is a disappointment, but the inventory could nicely have fared far better in a much better sector. With the stock down 24{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488} above the very last a few months, the market will not appear to believe that the company has solved all its troubles. Supplied the rather quick record of this inventory, we would keep on being pretty cautious until we see some sturdy enterprise functionality. You may possibly want to evaluate this data-wealthy visualization of its earnings, revenue and funds move.

If you are like me, then you will not want to pass up this free of charge listing of developing corporations that insiders are shopping for.

Make sure you take note, the marketplace returns quoted in this article mirror the industry weighted normal returns of stocks that at present trade on US exchanges.

Valuation is complicated, but we are aiding make it very simple.

Discover out no matter whether Magnificence Wellness is perhaps in excess of or undervalued by examining out our comprehensive examination, which includes honest worth estimates, dangers and warnings, dividends, insider transactions and monetary health and fitness.

Look at the No cost Assessment

Have opinions on this posting? Concerned about the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This short article by Basically Wall St is basic in character. We supply commentary based mostly on historic information and analyst forecasts only working with an unbiased methodology and our content are not intended to be financial guidance. It does not represent a recommendation to buy or promote any stock, and does not just take account of your aims, or your fiscal circumstance. We intention to carry you extensive-phrase centered investigation driven by essential facts. Take note that our examination could not element in the latest cost-sensitive business announcements or qualitative substance. Just Wall St has no position in any stocks pointed out.