The Elegance Wellness Organization (NASDAQ:Pores and skin) shareholders could possibly understandably be very anxious that the share cost has dropped 43{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488} in the very last quarter. But that will not transform the truth that above twelve months the stock has finished definitely nicely. In that time we have seen the inventory easily surpass the sector return, with a gain of 38{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488}.

Because the extensive expression efficiency has been good but there is certainly been a recent pullback of 31{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488}, let us check if the fundamentals match the share selling price.

Since Natural beauty Wellbeing manufactured a reduction in the previous twelve months, we imagine the current market is possibly a lot more focussed on profits and revenue progress, at least for now. Shareholders of unprofitable organizations ordinarily be expecting powerful profits advancement. Some organizations are ready to postpone profitability to improve income more quickly, but in that situation a single does hope superior top-line expansion.

Magnificence Well being grew its income by 68{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488} final yr. Which is a head and shoulders above most loss-making organizations. When the share value attain of 38{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488} in excess of twelve months is rather tasty, you could argue it won’t fully replicate the solid profits development. If which is the case, now may well be the time to choose a shut glimpse at Attractiveness Well being. Human beings have problems conceptualizing (and valuing) exponential development. Is that what we’re looking at here?

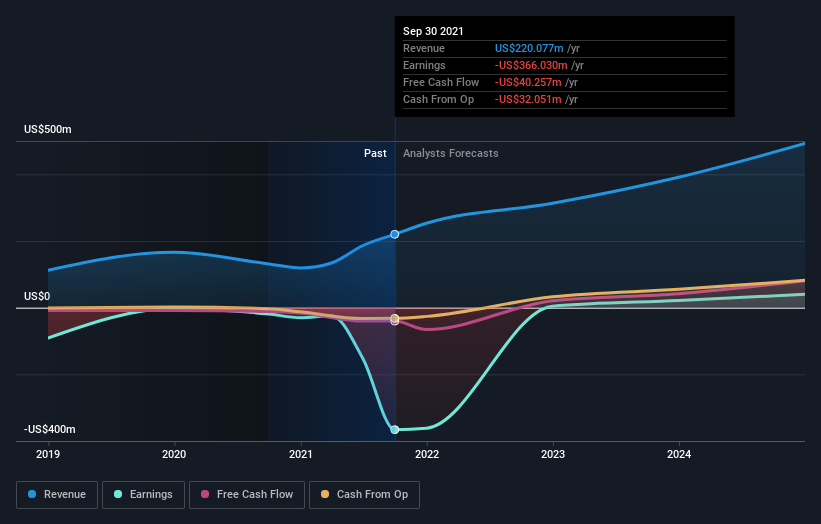

The graphic beneath depicts how earnings and earnings have transformed about time (unveil the exact values by clicking on the graphic).

Attractiveness Wellness is very well recognized by investors, and loads of clever analysts have tried out to forecast the future financial gain stages. If you are pondering of shopping for or advertising Elegance Health and fitness inventory, you must check out this no cost report showing analyst consensus estimates for future profits.

A Unique Standpoint

Natural beauty Overall health boasts a overall shareholder return of 38{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488} for the previous calendar year. Sadly the share cost is down 43{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488} more than the past quarter. Shorter term share selling price moves typically do not signify a great deal about the business enterprise by itself. I obtain it extremely attention-grabbing to glance at share cost around the prolonged phrase as a proxy for business general performance. But to really achieve perception, we will need to take into consideration other info, too. Choose risks, for instance – Natural beauty Wellbeing has 2 warning indications (and 1 which doesn’t sit far too effectively with us) we feel you ought to know about.

If you are like me, then you will not want to skip this free record of developing firms that insiders are shopping for.

Remember to notice, the current market returns quoted in this article replicate the industry weighted normal returns of shares that now trade on US exchanges.

Have suggestions on this posting? Worried about the content? Get in touch with us straight. Alternatively, e mail editorial-staff (at) simplywallst.com.

This write-up by Simply Wall St is typical in nature. We provide commentary primarily based on historical info and analyst forecasts only using an unbiased methodology and our articles are not meant to be money tips. It does not constitute a suggestion to invest in or market any stock, and does not acquire account of your goals, or your monetary condition. We purpose to deliver you prolonged-time period centered evaluation pushed by basic facts. Note that our evaluation could not component in the latest selling price-sensitive firm announcements or qualitative content. Only Wall St has no placement in any shares described.

The views and viewpoints expressed herein are the views and thoughts of the writer and do not necessarily replicate these of Nasdaq, Inc.