Valerii Apetroaiei/iStock via Getty Images

Your skin is, whether you believe it or not, the largest organ of your body. It serves multiple functions, ranging from protecting our interior organs to enabling vital sensations that help us understand the world around us. For these reasons and more, it’s incredibly important that we take care of our skin to the best of our abilities. So naturally, it stands to reason that there would be some firms that would be dedicated to helping us achieve that goal. One such business is The Beauty Health Company (NASDAQ:SKIN).

This small company has, in recent years, exhibited tremendous upside in revenue. Profitability has been mixed in nature, but the near-term outlook according to management is encouraging. Long term, it’s likely that the company will continue to grow from here. But this doesn’t mean that shares make sense to buy into at this time. Because of profitability concerns, shares of the enterprise do still look rather expensive. Even if rapid growth continues, it’s difficult to justify any meaningful upside for now for the business. But at the same time, it might be foolish to bet against the company. So because of the strong growth somewhat offsetting the high trading multiple of the company, I have decided to rate shares a ‘hold’ for now.

A prospect for your skin

According to the management team at The Beauty Health Company, the company is focused on providing beauty health experiences aimed at improving customers’ skin, their bodies overall, and their self-confidence. Their primary product is called HydraFacial and, based on the data provided, it focuses on cleansing, peeling, exfoliating, extracting, infusing, and hydrating the skin using its own proprietary products and processes. This platform relies on what is referred to as a razor / razor blade business model wherein the delivery systems that are typically sold to a network of medical providers act as the razor and certain consumables, like patented, patterned caps that are placed on the handpiece of the delivery systems in order to create suction and deliver solutions and serums to the skin, as well as formulations of special ingredients aimed at improving the HydraFacial experience, are the razor blade. This sort of business model has always been interesting to me because it often involves the sale of a high-priced, low-margin product at the beginning, that is then followed up by a steady stream of higher-margin income in perpetuity so long as the system originally sold continues to be used.

In addition to its existing products, the company is also working on other technologies that it believes could be instrumental in adding value for its investors. One example is the Syndeo, which management has described as being the next generation HydraFacial delivery system that it hopes to launch this year. In 2021, the company also launched the HydraFacial Nation app that provides consumers with information about their skin health, the option to discover which treatment options are best for them, and the ability to track treatments over time. And finally, the company is also working on a product called Keravive, which will act as a treatment for scalp health that includes an in-office aspect and a 30-day take-home spray.

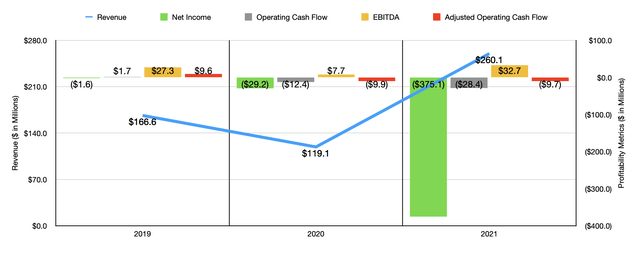

Author – SEC EDGAR Data

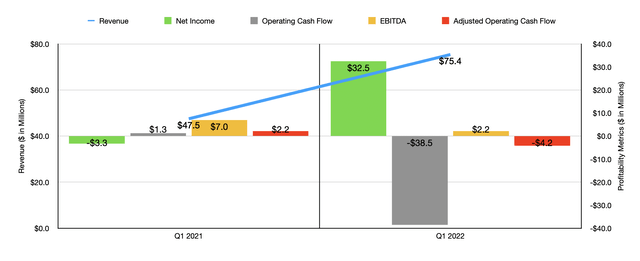

The general trend for the business over the past few years has been rather interesting. After seeing revenue fall from $166.6 million in 2019 to $119.1 million in 2020 because of the COVID-19 pandemic, revenue then soared to $260.1 million last year. Growth for the company has remained strong heading into the 2022 fiscal year. Revenue in the latest quarter, for instance, came in at $75.4 million. That represents an increase of 58.7{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488} over the $47.5 million reported just one year earlier. This particular rise was driven by two primary factors. For starters, delivery system net sales jumped by 61.9{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488} year over year, climbing from $25.7 million to $41.6 million. This came as the company sold 1,849 units during the quarter. Consumables sales grow a slightly more modest 54.4{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488}, rising from $21.9 million to $33.8 million.

Although the general trend for revenue has been positive for the company, the same cannot be said of profitability. In fact, the company has seen its bottom line worsen during this time frame. The company went from a net loss of $1.6 million in 2019 to a loss of $375.1 million in 2021. But as with any small, rapidly growing enterprise, it’s better to look at cash flow instead. In this case, the picture does look slightly better, with the metric falling from $1.7 million to negative $28.4 million. If we adjust for changes in working capital, it would have also fallen, but the decline would have been modest, starting at $9.6 million and ending up at negative $9.7 million. Meanwhile, EBITDA went from $27.3 million in 2019 down to $7.7 million in 2020 before rebounding to $32.7 million last year.

Author – SEC EDGAR Data

When it comes to the 2022 fiscal year, management has some pretty high hopes. Right now, they are forecasting revenue of between $330 million and $340 million. This beats out the prior expectation of between $320 million and $330 million. If the company were to hit the midpoint of the range, it would translate to a year-over-year growth rate of 28.8{362bf5cdc35eddfb2532d3c23e83b41deb229c4410d15cb1127c60150cbd4488}. Management also expects EBITDA to improve this year, with a forecast of $50 million for that metric. No guidance was given when it came to other profitability metrics. In truth, I feel as though net income it’s definitely not worth looking at considering the company’s historical track record and its stage of development and growth. Operating cash flow probably is worth looking at. A rough approximation of that, based on the EBITDA for the company, should be around $36.4 million.

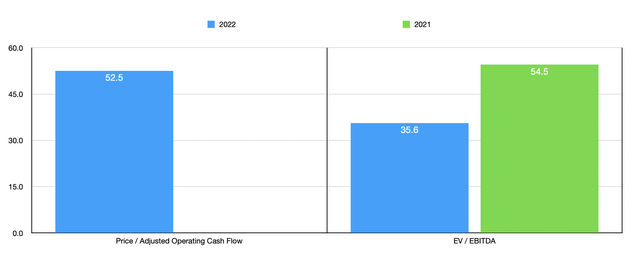

Author – SEC EDGAR Data

Taking this data, we can very easily value the business. On a price to adjusted operating cash flow basis, the company is trading at a multiple of 52.5. Since cash flow was negative last year, there is no comparison. Meanwhile, the EV to EBITDA multiple should come in at 35.6. That would be down from the 54.5 reading that we got when relying on 2021 figures. To put the pricing of the company into perspective, I did compare it to five similar firms. On a price to operating cash flow basis, these companies range from a low of 4 to a high of 89.1. Four of the five companies were cheaper than The Beauty Health Company. Using the EV to EBITDA approach, the range was from 6.3 to 32.6. In this scenario, The Beauty Health Company was the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| The Beauty Health Company | 52.5 | 35.6 |

| Medifast (MED) | 27.2 | 8.2 |

| Edgewell Personal Care (EPC) | 10.3 | 11.0 |

| e.l.f. Beauty (ELF) | 89.1 | 32.6 |

| Nu Skin Enterprises (NUS) | 12.9 | 6.3 |

| Herbalife Nutrition (HLF) | 5.1 | 6.3 |

Takeaway

From a growth perspective, The Beauty Health Company is doing quite well right now. At the same time, profitability has not been exactly great. Management does seem to think that this will change in this current fiscal year. But even if that does come to pass, shares of the enterprise look very expensive on an absolute basis and they are expensive relative to similar firms. For all of these reasons, I have decided to rate the business a ‘hold’ at this moment.